Let markets allocate CDR

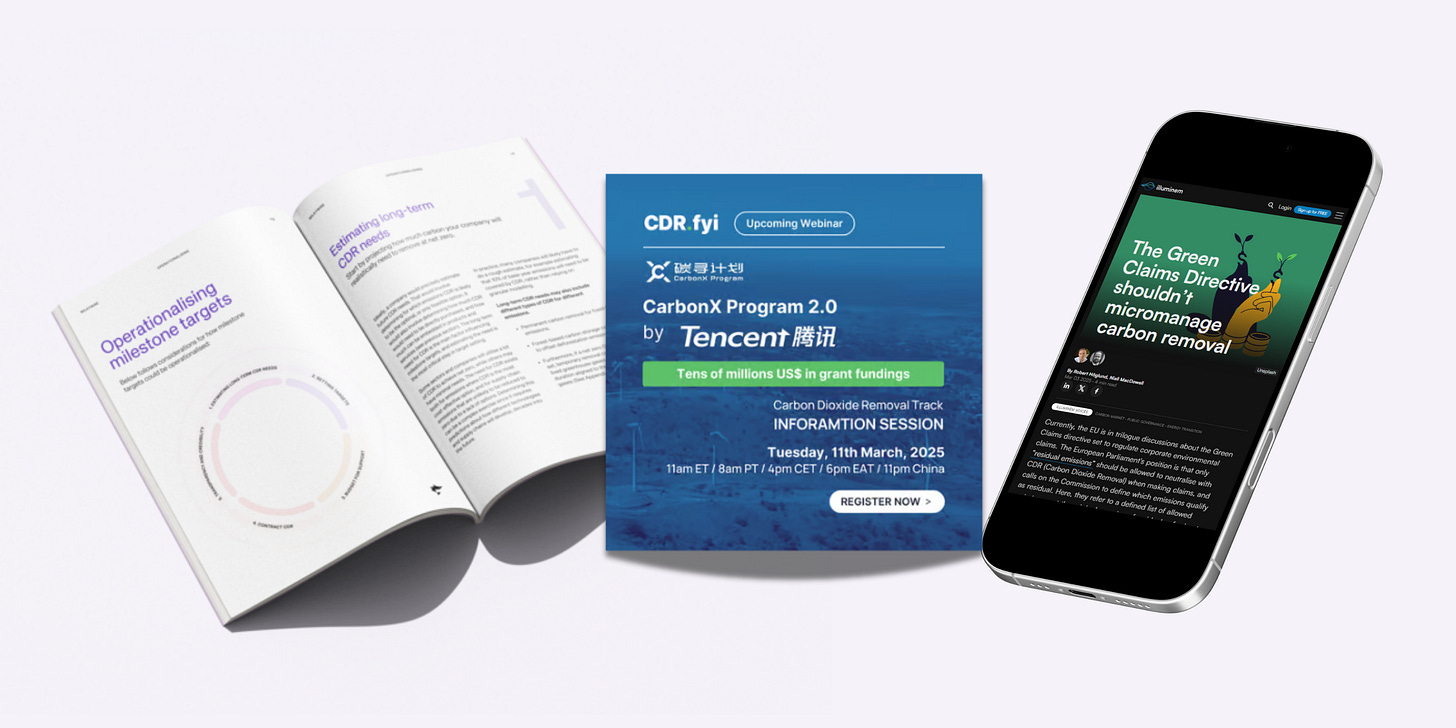

Three pieces of news: Free market CDR op-ed, Corporate carbon removal target setting white paper, and a new multimillion funding opportunity.

Don’t ration carbon removal

On Monday, an op-ed I wrote with professor Niall Mac Dowell was published in Illuminem, The Green Claims Directive shouldn’t micromanage carbon removal.

There is a longstanding trend in talking about CDR as a finite good that needs to be carefully allocated to sectors that have no other option. But that’s a misunderstanding. Hardly any CO2 emissions are impossible to bring to zero. CDR is a tool to reach net zero faster and cheaper. A choice, not a must.

In the currently negotiated Green Claims Directive, the EU Parliament’s position is that only predefined “residual emissions” should be allowed to neutralise with CDR. But the message goes beyond the directive.

The European Sustainability Reporting Standards (ESRS), which sets the rules for corporate CSRD reporting, has a similar problem defining net zero as “90-95% emission reduction”. The current SBTi net zero standard says 90% reduction and max 10% removals (but is being revised).

On a global level, this may be a good guess on how much CDR will be needed, but requiring all companies to follow such a cap would make net zero more expensive and, above all, much slower to achieve. We should not stop companies that want to reach net zero before 90% reductions have been achieved as long as they use safe, permanent CDR to neutralize remaining emissions.

Our key points in the article are:

⌛ When CDR is the best option will vary with time and technology development, this can only be projected, not predicted. We should not set a strict cap on how much CDR companies can use voluntarily.

🚦 Conditional on strict quality and safety guardrails, markets will be best at allocating CDR to where it's optimally used. We should not limit use cases to a predefined list of allowed emissions for CDR neutralization.

🔄 Key to all of this is that CDR isn’t “used up.” While availability is limited, it’s not a depletable resource that needs to be rationed.

This doesn’t mean we shouldn’t try to project where CDR will indeed be the best option. That is very important for planning. More to come on that.

Corporate carbon removal targets in practice

Today, Milkywire published a white paper on setting a Corporate carbon removal target, co-authored by me.

Just as credible pathways to corporate net zero need emission reduction targets on the way, they need increasing CDR procurement targets. Otherwise, the sector simply won't grow to fill the needs at net zero.

The paper is filled with thoughts on the how-to of CDR target setting. Why, when, how much, what, whom? Volume or monetary targets? Prepurchases or offtakes? How do CDR targets fit with wider climate support and internal carbon fees?

Our key recommendations are:

1. Estimate long-term CDR needs for reaching net zero targets.

2. Set near-term, annual delivery or budget-based targets aligned with long-term needs. Consider setting monetary targets in the short-term to avoid too early cost competition in the nascent CDR sector. Follow the “like-for-like” principle and match the permanence of CDR to the emissions, e.g. only durable CDR for fossil emissions.

3. Budget for CDR and wider climate support. Consider using an internal carbon fee to finance both CDR and other Beyond Value Chain Mitigation (BVCM) actions, adjusting it over time as targets evolve.

4. Contract CDR. Support a diverse range of CDR methods, rather than just the cheapest, to drive innovation, spread risk, and grow the market. Consider a “catalytic buying” approach to prioritize neglected opportunities.

5. Communicate transparently by publicly disclosing plans, progress, and challenges.

Corporate carbon removal targets with interim milestones are anticipated to be the number one demand driver for CDR in the coming years. Hopefully, the SBTi Net Zero Standard 2.0 and the ISO Net Zero Standard will both convey a clear message on this topic.

Hopefully, our guidance helps. This is version 1.0, and we anticipate updates. We certainly don't have all the answers, comments and feedback are much appreciated.

New multimillion CDR funding opportunity

Tencent’s new CarbonX Program 2.0 offers multimillion-dollar support per project for CDR technologies and is now open for applications. For universities, research institutions, and startups aiming to scale breakthrough CDR solutions.

At CDR.fyi we are hosting a joint information session webinar with Tencent CarbonX Program managers on Tuesday, March 11th. Join us to learn about proposal requirements, selection criteria, and implementation details ahead of the May 2025 application deadline.

Marginal Carbon is great! Best I've seen for up-to-date news on CDR market.

I enjoyed reading the article. I am probably one of those the article is directed at, sceptical, particularly of land-based CDR. I think potential from land-based measures incl. BECCS is quite strongly limited by a range of institutional, economic, social and environmental factors.

If we can somehow move the conversation on to EW & DACCS being the technologies with most potential to scale (if EW works) and setting up funding streams for those, then I am strongly supportive. With these technologies, market-based allocation is surely best.

But as long as we are relying on other land-based measures, I think these do have to be rationed. Ability to pay for removals is not the same as the need, particularly when it comes to food production.

Thanks again for the blog; I find it very interesting to get an alternate perspective to mine.